Car – Monetary advantage when evaluating the actual journeys individually using the 0,002 percent method in SAP HCM

In the course of the increased use of the home office, this evaluation method is moving more into the focus of consideration. We take this as an opportunity to shed more light on this assessment.

Ingredients needed:

- Model wage type: M810

- Infotypes: 0032 (Internal company data), 0006 (addresses for the distance KM) 0014 (recurring payments and deductions) or alternative 2010 (remuneration receipts)

- Calculation rules: D011, DSP0 and DSP6

- Constants: T511K = car**

The simplest way of displaying the facts is to copy the wage type M810 into the customer namespace, everything else then works almost automatically.

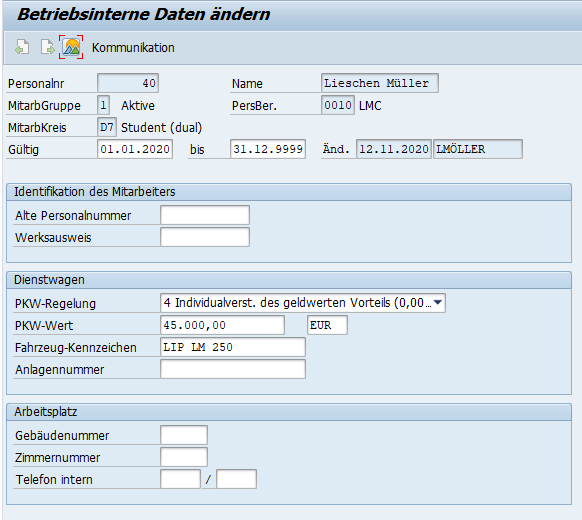

Adding the company car data in the infotype Internal Data (0032)

Car control 4 must be selected.

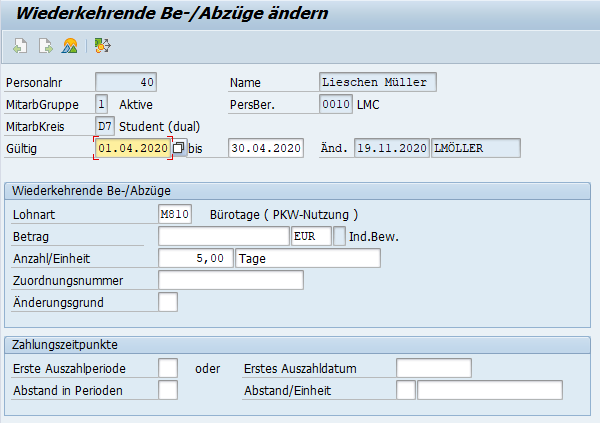

Enter the wage type in infotype 0014 (recurring payments and deductions).

The wage type is to be entered without an amount, only with the number and the unit days.

This solution makes it possible not the individual office days to give up.

However, the legal requirement requires proof of the office days, which must therefore be documented elsewhere.

Legislative requirement:

The employee must explain to the employer in writing every calendar month on which days (with the date) the company car was used for trips between home and the first place of work. Merely specifying the number of days is not sufficient. The employer is obliged to include these written declarations with the wage documents. If the employee has not clearly provided incorrect information, the wage tax must be carried out according to these declarations. For reasons of simplification, it is possible to carry out the income tax deduction based on the declaration of the previous month, i.e. to record the proven individual trips with a time delay of one month.

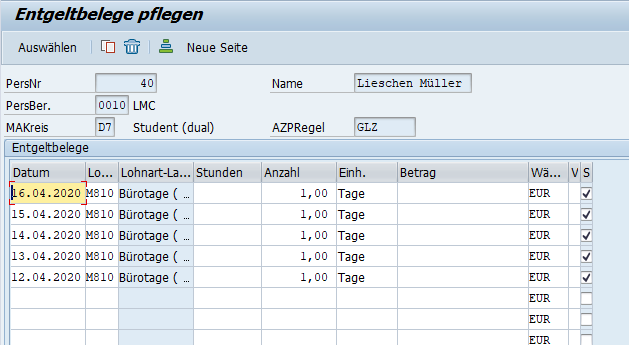

Record office days in IT 2010 (remuneration receipts).

If the office days are to be entered individually in infotype 2010 (remuneration receipts) for reasons of transparency, this will not work without further ado with wage type M810. To ensure this, further adjustments are necessary. If wage type M810 is entered in infotype 2010, this leads to termination of RPCALCD0.

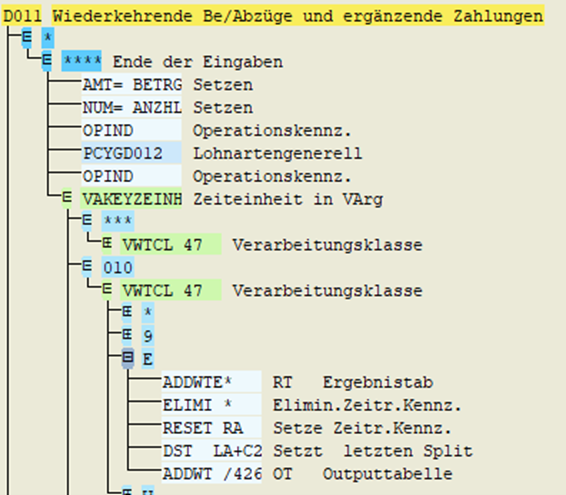

The reason for this is that wage type M810 is transferred directly to wage type /0014 when infotype 426 is imported. This is done in calculation rule D011 (recurring payments/deductions and additional payments). Processing class 47 is imported in this rule. If this has the specification E (office days for company car taxation), the content of the wage type is transferred directly to wage type /426 (PKW-KM gw.Vorteil).

So if infotype 2010 is to be used, the rule shown above must be mapped in a customer-specific rule. Wage type M810 or the customer wage type to be created must be processed in the same way. This must be done in the gross part of the L&G statement after importing infotype 2010.

If infotype 2010 is used, it is recommended to use list entry.

The result is the same as when you entered infotype 0014.

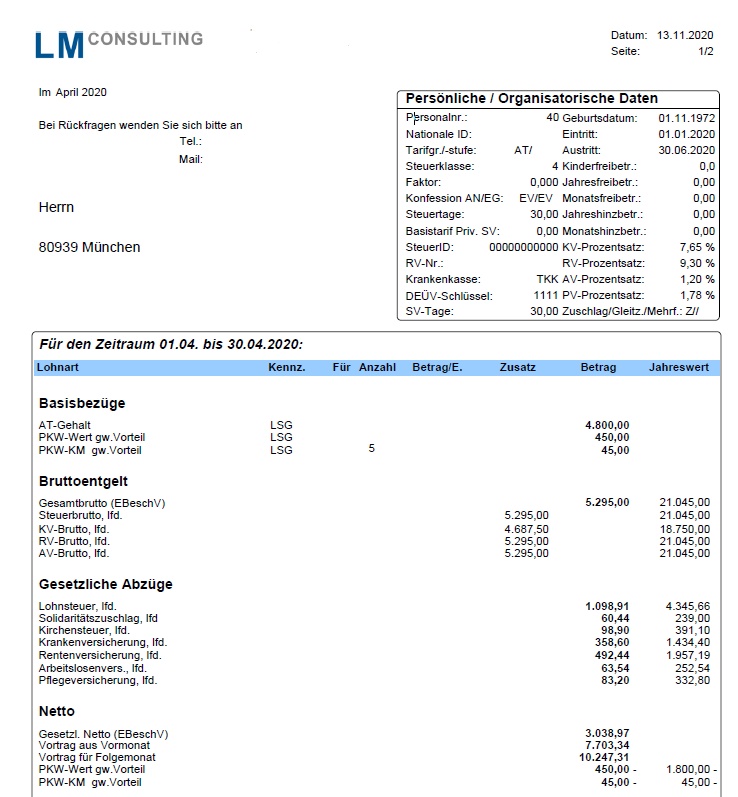

Payslip

Do you have questions about monetary benefits in SAP HCM or do you need further help? Contact us via the contact form and send us a message.