Implement bike leasing via salary conversion in SAP HCM

This article shows the implementation of the company bike as bicycle leasing via salary conversion in SAP HCM

Note:

For better readability, the simultaneous use of the language forms male, female and diverse (m/f/d) is avoided. All personal designations apply equally to all genders.

1. Introduction

If you lease a company bike from your employer, you not only save a lot of money, you also keep fit at the same time. Due to the tax advantages, a company bike is worthwhile for both employees and employers. In addition to the tax benefits, the employer can expand the "Benefits Catalog" and thus increase their own attractiveness as an employer.

Initial Situation:

- The monthly installments of the leasing contract are serviced from the gross salary

- are subject to income tax 0,25% the gross list price (BLP) of the bike

- In the case of S-Pedelecs (up to 45 km/h), the kilometers traveled are also included 0,03% of the BLP quartered and rounded down to a full hundred, analogous to the electric company car

- The sales tax obligation still applies to 1% of the BLP

*S-pedelec: Pedelec or e-bike with a maximum speed of over 25 km/h

2. Solution concept

In our solution, we do not use infotype 0032, as otherwise there could be complications for employees who use both a company car and a company bike. Instead, we opted for a solution using the Infotypes 0014 .

If an employee is granted the use of a company bicycle, the following amounts are recorded in infotype 0014 for the leasing period:

- Monthly leasing rate for the company bike (gross)

- Gross list price of the service bike

- Distance kilometers (only for S-Pedelec)

In the payroll run, the subject to income tax Percentage of 0,25% is calculated and included in the net calculation.

The sales tax is calculated using the Sales tax automatic a ledger account.

3. Wage types

| wage type (example) | Long text | Usage | Input/Generation |

| 8930 | Paid transit Salary conversion | Leasing rate as gross retention | IT0014 |

| 8931 | Jobrad reference value | BLP is recorded and taxable portion AMV is calculated | IT0014 |

| 8932 | Jobrad LST free portion | Income tax-exempt portion gwV | Machine calculation |

| 8933 | Jobrad LSt fr.Ant Ust Kor | Correction of sales tax | Machine calculation |

| 8934 | Jobrad distance kilometers car | Distance kilometers are recorded and taxable portion is calculated | IT0014 |

4. Billing Scheme

The calculation of the taxable shares and the adjustment amounts takes place in gross part payroll, directly after importing infotype 0014.

5. Example: Bicycle Leasing SAP HCM

In this example, employee Daniel Radler leases in S-pedelec with a gross list price of 3.000,00 € and a monthly leasing rate of 44,00 €. He lives 10 km away from his place of work.

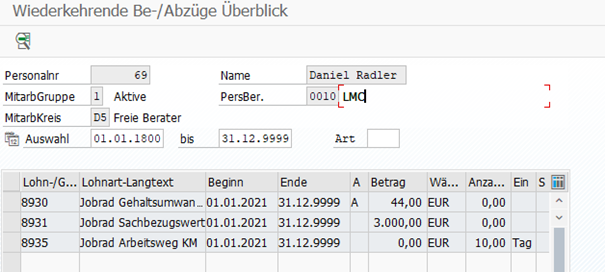

The following data is then recorded in infotype 0014:

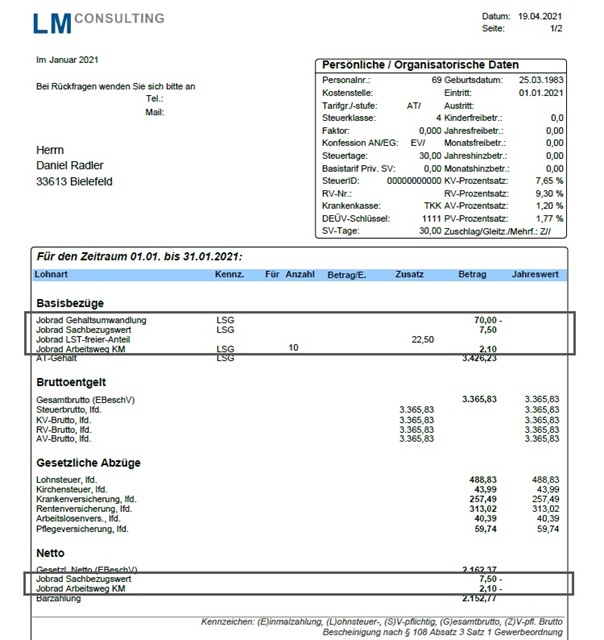

The system calculates the LST-liable portion of 0,25% of the gross list price, in this case 7,50 €. These flow into the gross salary and are then deducted from the net salary.

Since this is an S-Pedelec in this case, the kilometers traveled must also be taxed. The 10 kilometers traveled are multiplied by the quartered gross list price rounded to the nearest hundred and 0,03%, resulting in an amount subject to income tax of 2,10 € accrues. This is also included in the gross salary and then deducted from the net salary.

The leasing rate is calculated as gross retention considered.

The result looks like this on the form:

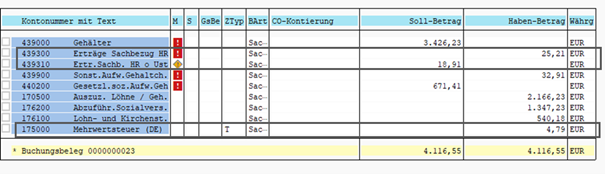

Finally, in the accounting document, the VAT calculation is based on 1% of the BLP and thus 30,00 € in this example.

Do you have any questions about bicycle leasing in SAP HCM or do you need further help? Contact us via the contact form and send us a message.